Tracking, Transparency &

Reputation Ratings

TRACKED VENDOR ANALYSIS

. Performance and News Update .

Latest Releases

ERI’s 2024 Impact Report: A Solid Foundation for Future Improvements in Metrics Reporting

ERI’s 2024 Impact Report offers a detailed look at the company’s role in environmental IT and secure asset disposition. Despite being a privately-held business, ERI set out to be more transparent, making it one of the few ITAD and material recovery companies...

Corporate Sustainability Brief: Samsung Electronics

I recently moderated a session at REMA 2025 in San Diego with Samsung Electronics' sustainability leaders, Daniel Araujo and Jenni Chun. It was a great conversation about what one of the world’s biggest technology companies is doing to make sustainability real—not...

Sustainability in Practice: Reviewing Hitachi Digital Services’ Strategy

So I spent some time researching how Hitachi Digital Services runs its business—specifically through the lens of sustainability—and I have to say, I came away impressed with what the company does and how it does it. Sustainability shows up in the work itself: in the...

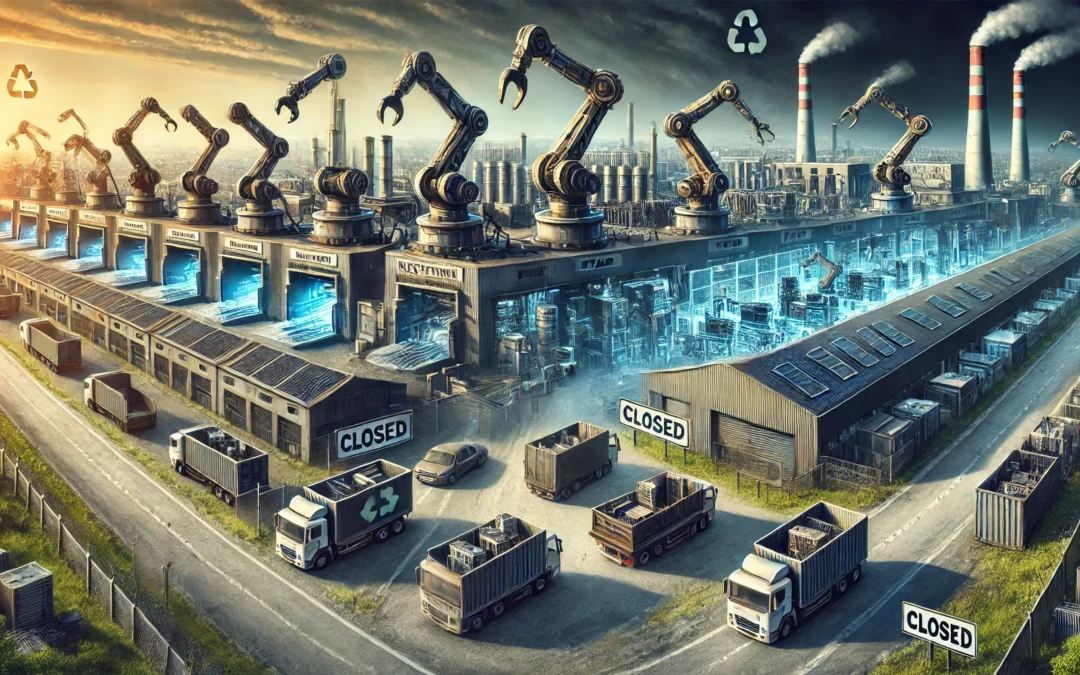

ITAD Shake-Up: Mergers, Exits, and Bankruptcies: Who Will Survive the Industry’s Ongoing Transformation?

The ITAD industry is undergoing a seismic shift—bankruptcies, mergers, and market exits are reshaping the landscape. The days of ‘two men and a truck’ operations are over as larger, well-funded players consolidate power. Smome companies are doubling down on ITAD, while others are retreating. The question now is: Who will survive, and who will be left behind?

Ingram Micro’s ITAD and Lifecycle Business: Straddling the Line

Summary: Ingram Micro’s latest 4Q2024 earnings call confirms the company’s focus on higher-margin businesses like cloud, digital solutions, and AI-powered automation. And while it continues to offer ITAD services, we are not likely to see an aggressive push in ITAD....

Ratings

ITAD Marketing Leadership Tracker

How are ITAD companies marketing their services? Who are the leaders?

10/2024 ITAD Executive Retreat

In October 2024, we will convene our first executive retreat in Miami

ITAD Go-to-Market Navigator

Need data to analyze your market and support your go-to-market? Reach out

Vendor Reputation Ratings

Looking to hire an ITAD company and you are not sure who? Take a look at what your peers are saying about their providers

ITAD Market Pulse

This is where analysts share their latest understanding of market conditions affecting the ITAD sector.