In January 2024, ITAD-related marketing was not confined to pure-play vendors alone. We are seeing many companies whose core businesses are not ITAD, yet they have been active in marketing ITAD services, often more aggressively than most pure-play companies. Companies in this category include IT asset management firms Inteleca and Zones.

There are also companies that are known for their ITAD operations such Insight and SHI, but whose principal core offerings are in other sectors such as IT equipment and components distribution. In this analysis, we have disregarded these companies to provide a general overview of what specifically ITAD-focused companies are doing. For comparison purposes, we will add a brief paragraph at the end of this report to incorporate non-pure-play vendors to confirm the potential ITAD marketing reach and universe for a better understanding of the total addressable market.

Why is Analyzing Online Marketing Crucial?

In an era dominated by social media and online marketing, analyzing web activity of any company provides a direct understanding of their Go-to-Market strategies and, by extension, their management practices. Compliance Standards uses multiple datasets, some propitiatory to CS, others purchased from reputable data owners, and others available in the public domain, to understand sector and company performances, from primary research to generate vendor reputation ratings, for example, to employee reviews to assess areas of ESG policy, and to marketing activity with data coming from major online raw data owners like Google to identify which companies have the proper go-to-market strategies. We work with aggregators and analytics platforms to produce reports that matter to us and to our clients.

ITAD Marketing Profile: General Trends

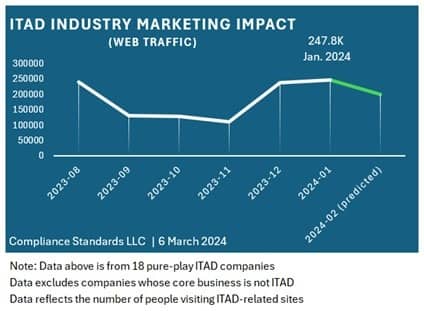

For the month of January 2024, the 18 ITAD companies assessed in this analysis (more to be added in upcoming tracker releases) generated a global traffic volume of 247.9K (site visits), up 8.53% from December 2023. The value of this traffic is estimated to be worth $68.6K, representing a relatively small amount but healthy enough for a niche sector like ITAD. The value of this web traffic into the ITAD domains was up 27.09% from December 2023, although we anticipate a downward correction for the month of February.

The data shows a resurgence of activity over the past two months ending January 2024, after traffic reached bottom in November 2023 when it fell to 111K. In this universe, organic search accounted for 38.26% of traffic in January 2024. Organic search results are the unpaid listings that show on search engine results pages. Direct connections accounted for 31.26%, while paid searches were responsible for only 0.54% of traffic.

However, Compliance Standards LLC anticipates a contraction in February 2024, with traffic estimated to drop by 19.6% month to month, reflecting lesser marketing efforts from the industry as the winter season progresses. See Figure 1 below.

Figure 1: ITAD Industry Marketing Impact: Web Traffic:

Most Active Vendors

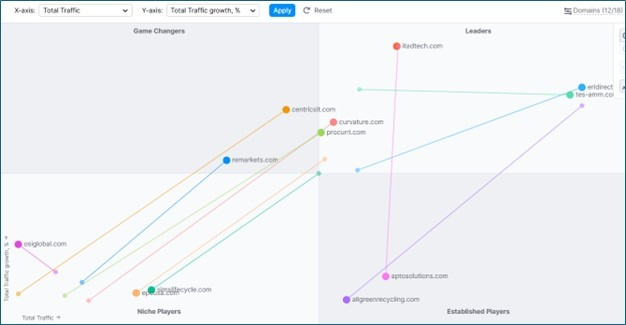

Firstly, it is important to note that the ITAD sector features a moderately low level of consolidation, based on the Herfindahl–Hirschman Index (HHI), reflecting the division of market share among market players. With 102.2K site visitors in January 2024, ERI’s share of traffic that month stood at 41.22%. More importantly, ERI increased its traffic from December by nearly 795%, indicating an ongoing aggressive marketing campaign aimed at keeping its brand in the leadership top-right corner of the Marketing Leadership Quadrant (see Table 1 below).

The boost in ERI’s position in January with strong percentage growth was an acceleration from its December boost, when traffic versus November grew by 44.9%.

What is significant is that ERI’s two biggest sources of traffic are referrals and direct, highlighting a proactive market strategy, rather than relying on traffic generated from paid keywords and links. Referrals accounted for a solid 53.7% of all its traffic, double the general market. Direct accounted for 44.57% (vs. 31.26% for the entire industry). Sprout Social defines ‘Referral traffic as the people who come to your domain from other sites, without performing search on Google. When someone visits a link from a social network or website and they end up on another site, tracking systems from Google recognize the visitor as a referral.” Direct traffic happens when visitors enter the domain URL directly into their browser. This situation shows that traffic into ERIdirect.com is not coincidental or the result of paid service and that puts ERI in a very strong position.

In line with the expected industry drop in traffic in February, Compliance Standards also predicts ERI will experience a reduction in traffic, likely reflecting a slowdown in its marketing campaign in the remaining winter season.

The second biggest marketer is TES (TES-AMM.com), with a 94.4K traffic volume in January 2024, accounting for 38.07% of global traffic. Mimicking the performance of ERI, TES’ traffic grew 693.5% month to month, also highlighting an active marketing campaign underway.

Lesser-known Georgia-based ITAD Tech was third largest marketer at 6.47% of total traffic in January. This is the first time we have seen ITAD Tech rise to the leadership position on the marketing front. However, we do not believe ITAD Tech will sustain such a position as this latest result is likely due to a one-off event that boosted organic traffic from an average of 390 per day to nearly 2,000 on January 21, 2024. Preliminary data shows a correction taking place in February, bringing back ITAD Tech to much lower traffic levels.

The fourth and fifth vendors, Apto Solutions and All Green Recycling, respectively, experienced a reduction in traffic in January after solid performances in December.

In the top-10 ITAD markets, we note the presence of Curvature, CWI, Procurri, CentricsIT and REMarkets, with top-10 vendor market share listed below.

Table 1: Top-10 Most Active ITAD Vendors Based on Traffic Metric

| Vendor | Traffic in 000 | Share of total traffic in percent | Growth vs. December 2023 |

| 1. ERI | 102.2 | 41.22 | +794.57 |

| 2. TES | 94.4 | 38.07 | +693.51 |

| 3. ITAD Tech | 16.0 | 6.47 | +1,462.48 |

| 4. Apto Solutions | 13.2 | 5.34 | -44.56 |

| 5. All Green Recycling | 5.5 | 2.22 | -96.02 |

| 6. Curvature | 3.7 | 1.48 | +386.62 |

| 7. CWI | 2.4 | 0.98 | N/A |

| 8. Procurri | 2.3 | 0.91 | +293.58 |

| 9. CentricsIT | 1.8 | 0.74 | +516.22 |

| 10. REMarkets | 1.5 | 0.59 | +106.84 |

| Others | 4.9 | ||

| Total | 247.9 | +8.53 | |

Figure 2: ITAD Growth Quadrant and Leadership Grid

What’s Worth Tracking:

Within the ITAD universe, it is worth mentioning some key players whose core business is not solely ITAD. Companies such as CDW, Insight, SHI, and Iron Mountain are among the firms that offer ITAD services, which likely account for a minor share of their revenues. Note that we do not include in this analysis OEMs such as Dell and HP, and leasing/financing giant IBM, even if they are significantly bigger market participants due to their relationship with clients and due to their business models. These companies will be subject to a separate review.

When adding non-Pure Play participants, site traffic exploded from 247.9K to 5.8 million, reflecting the marketing power these non-core ITAD market participants have. In this context, we note that CDW attracted the highest volume of traffic with 48.9%. This is certainly not a surprising finding since CDW relies on its e-commerce website to generate business opportunities and perform business transactions.

Although it has a different business model, solutions integrator Insight was the solid second in January with a 30.99% market share, followed by SHI at 10% and Iron Mountain at 3.43%.

Specific to Iron Mountain, while most of its ongoing campaign focuses on document shredding and other principal core businesses, it has been making a lot of noise in marketing its data center decommissioning services. In general, Iron Mountain was an extremely active online marketer in January, measured by total traffic it managed to attract. Fresh with its acquisition of Regency Technologies, IronMountain.com attracted 198,700 visitors. However, and while its ranking stayed the same, from December 2023 to January 2024, IronMountain.com traffic fell by 4.8% month to month. Yet, we expect to see and hear more from Iron Mountain in the months to come as it seeks to promote its ITAD operations going forward.

About Compliance Standards’ ITAD Marketing Leadership Tracker

Compliance Standards’ ITAD Marketing Leadership Tracker analyzes the performance of companies involved in the ITAD sector. The Tracker is released monthly, focusing on identifying the most active market participants, identifying their positions relative to competitions, strengths and weaknesses, pinpointing the factors that make them and their marketing campaigns successful, and how they contribute to the overall improvement of the ITAD sector. In addition to ITAD clients, we service the financial sector, helping investors identify leaders and laggards in the sector. We also help end-user companies find partners that could deliver services that meet their ever-growing ESG requirements.

The next ITAD Marketing Leadership Tracker report will be released at the end of March. To learn about subscription to this service, please contact us here: https://compliancestandards.com/consultation/

Compliance Standards LLC also supports companies in their go-to-market strategies using data and analyst expertise, with a series of custom services tailored to their specific needs. To find out more, please visit to book an analyst meeting. https://compliancestandards.com/consultation/