By David Daoud: Wall Street loves companies that are number one in their respective business sector, and lead in market share. However, I used to tell my clients that it may not always be the optimum stance in being number one. Firstly, that’s the ceiling, even if you have room to capture more market share, there is still nothing higher than number 1. Then there is the crazy amount of scrutiny from investors. They will want more and more of you, and then as a CEO or CFO, you are constantly worried about how you will share news and updates in the next earning season that would help maintain the company’s lead. And if there is no good news, it’s mayhem. I think the number two company is probably better positioned. There is less scrutiny, and you can still do very well.

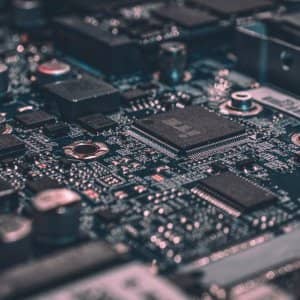

Case in point: Intel and AMD are generally in the same business. They have a huge impact on the ITAD and recycling sector by virtue of their contribution in defining today and tomorrow’s technology. Their work can speed up or slow a refresh cycle. They can get end-users to retain their system longer and vice versa. They can sway vast numbers of partners to follow their lead. Intel has about 250 such partners, and it can orchestrate product launches, roadmaps, etc.

Intel is much bigger, with 2023 market capitalization of some $150 billion to $200 billion, though as of today (August 2, 2024), it fell below $100 billion due to a rough quarter. AMD is typically around $100 billion to $150 billion, settling today at some $134 billion. Intel’s 2023 revenue was approximately $54.23 billion, vs. $22.7 billion for AMD. Everyone knows Intel holds the lion share of the CPU and GPU markets, upward of 60-70% in the desktop and laptop CPU space. In the server market, Intel tends to peak at 75-85%, etc.

________

This analysis is reserved for clients subscribing to the Pulse Service.

Already a subscriber? Please log in here.

Not a Pulse subscriber? Click here to subscribe

Or schedule a free consultation here to learn more.